Regulatory Intelligence and Assessments to Help Manage Change Faster and Better

Optimizing compliance while keeping up with regulatory changes can be difficult without modern solutions. Improving and enhancing your entire process for compliance, insights, monitoring, audits, performance, and decision making are just some of the benefits provided by the Predict360 Regulatory Change Management software application.

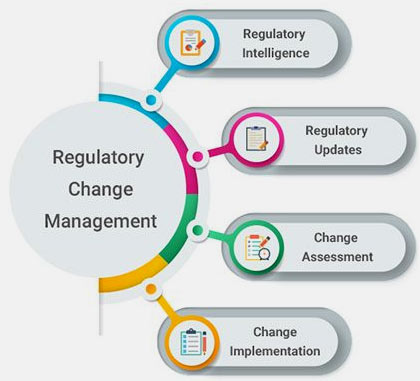

Become more efficient with a solution that provides the latest regulatory intelligence, updates about regulatory changes, news, assessment of the impact of changes, and change activity management all under one unified platform.

Your Business, Empowered with Regulatory Change Management Solutions

- Regulatory intelligence, updates, and news from a variety of external sources collected in one feed, so you always stay up to date.

- Intelligent parsing of regulatory updates to highlight changes and the applicability of said changes.

- An automated AI-powered preliminary assessment of the impact of changes and the business units affected by them based on risk mapping.

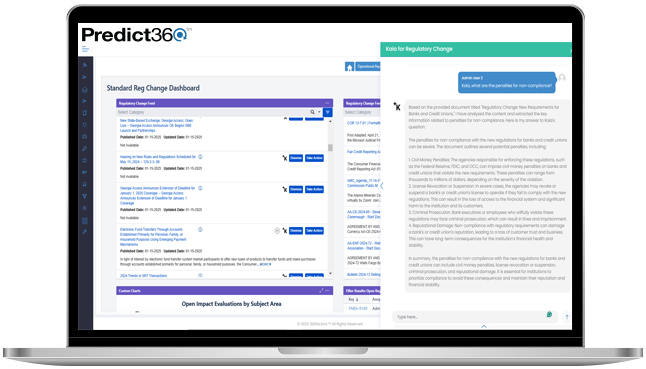

- User Q&A with Kaia, our integrated, chat-based AI companion. This specialized assistant has been trained on reference documents, enabling it to provide detailed and contextually specific answers to Regulatory Compliance queries.

- Clients can store their policies and procedures in the Document Management System (DMS) and flag them as policies. When a regulatory change occurs, Kaia can identify which policies and procedures are affected by specific regulatory changes, streamlining compliance management and reducing manual efforts.

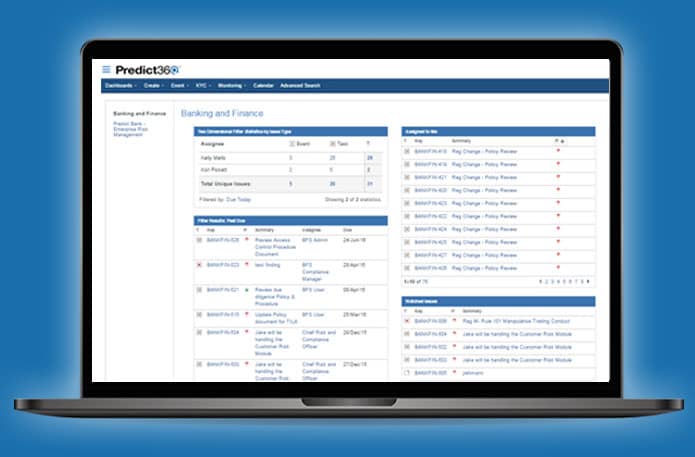

- Project plans that track and manage multiple, simultaneous tasks and integrated regulatory intelligence feeds as well as Regulatory Examinations and Findings Management.

- Automated notifications to relevant stakeholders about all related audits, policies, rules, and documents affected by changes.

- A real-time executive view of regulatory issues across the organization.

Regulatory Change Management Challenges

- Manual risk and compliance tools are ineffective in managing regulatory changes and activities and aggregating risks from all the departments into a holistic view of the organization.

- Financial institutions must keep track of a large volume of regulatory changes across multiple jurisdictions, which can be overwhelming and time-consuming to manage without AI-powered solutions.

- The use of different tools across multiple departments increases costs, creates silos and results in data and reports that cannot easily be compared or combined.

- Silos are a major obstacle for risk and compliance executives that require up-to-date business intelligence to make the right decisions in a timely manner.

- Understanding how regulatory changes affect existing processes, products, and systems is crucial but requires extensive manual interpretation and assessment, which can be difficult to manage.

Regulatory Management Software Key Features

Predict360 RCM delivers enhanced regulatory change management performance with powerful features such as:

Intuitive Reports and Dashboards

Predict360 ensures that regulatory change management activities are managed well by providing real-time dashboards and automated reporting through Power BI and Tableau BI. Managers can easily drill down from the dashboards and reports to get more details about activities and open issues.

Regulatory Change Monitoring

Predict360 RCM provides automated updates and notifications about changes in regulations. A regulatory intelligence feed provides users with the latest reports and news about upcoming regulatory changes.

Regulatory Impact Analysis & Reporting

Predict360 RCM also enables automated impact analytics and streamlined assessments through Generative AI technology. The powerful regulatory engine in Predict360 RCM uses risk maps to help businesses quickly understand the impact of upcoming regulatory changes on the processes, documents, policies, and controls being used within the organization.

Why Choose 360factors?

360factors empowers organizations to accelerate profitability, innovation, and productivity by predicting risks and streamlining compliance.

Complete GRC

All the GRC tools you need integrated in one solutionBasic to Enterprise

From simple risk assessment to complete risk register and control testingSpeed & Execution

Insights into your risk program & control effectivenessFast Implementation

The cloud-based solution can be integrated within daysFlexible and Modular

Pick the modules you need for your businessEasy to Use

Automation and an intuitive interface ensure ease of useLearn How 360factors Empowers Customers to Manage Their Risk and Compliance Programs with Ease.

We look forward to working with 360factors to advance our enterprise risk and compliance programs for the bank while increasing the products and services we offer to the community.

Mark Casel Chief Risk Officer

We selected Predict360 due to its ease of use, banking industry design, and endorsement by the American Banker’s Association.

Eric Sprink President & CEO

Predict360’s banking workflows, risk library content, and endorsement from the American Bankers Association are a great fit for our bank.

Julie Dahle EVP and Chief Risk Officer

Predict360’s out-of-the-box applications designed specifically for banks our size along with their banking content was a significant influence in our selection of 360factors.

John Dunne EVP Chief Risk Officer

As part of our initiative to expand our products and services, we wanted to enhance our enterprise risk and compliance management to support this growth. Predict360 will enable our team to meet these goals efficiently.

David Claussen Chief Risk Officer

360factors’ solutions, powered by artificial intelligence, enables our organization to adapt and respond effectively to the ever-changing regulatory compliance landscape.

Joanna Chancellor Business Support Manager

The powerful features combined with the easy implementation of the cloud solution made Predict360 a great fit for our organization.

Steve Parker Chief Executive Officer

We believe our collaboration with 360factors and the technology they bring supports our vision for the future.

Gina Anonuevo Chief Compliance Officer

Deploying Predict360 is another step by us towards becoming a more streamlined and efficient organization.

Crystal Barnes Regulatory Compliance Specialist